Financial Projections in Business Planning: A Guide

In the world of business, financial projections are a crucial tool for planning and decision-making. They provide a roadmap for the future of a company, helping to guide strategic investments, manage cash flow, and assess the overall financial health of the organization. Without accurate and reliable financial projections, businesses risk making uninformed decisions that could have serious consequences for their bottom line.

Components of Financial Projections

When creating financial projections, there are several key components to consider. These include revenue forecasts, expense projections, cash flow statements, and balance sheets. Revenue forecasts estimate the amount of income the business expects to generate over a specific period, while expense projections outline the costs associated with running the business. Cash flow statements track the movement of cash in and out of the company, while balance sheets provide a snapshot of the company’s financial position at a specific point in time.

Creating Realistic Financial Projections

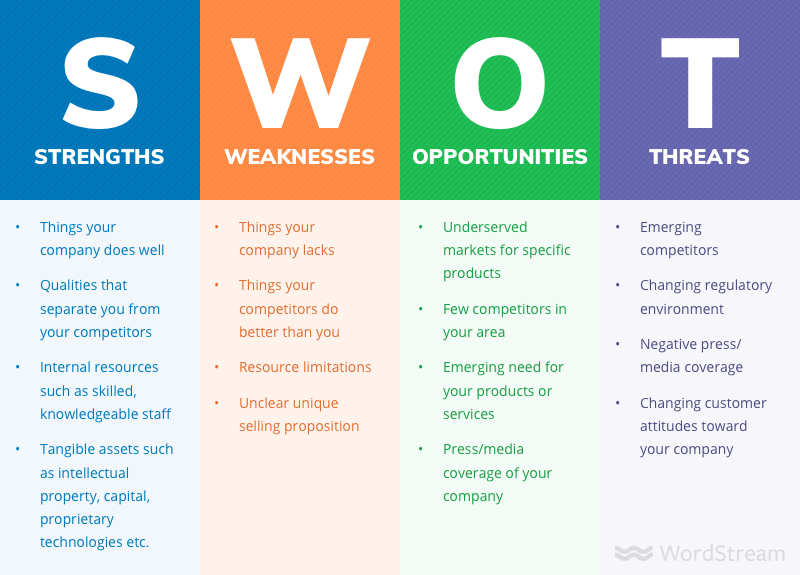

It’s essential to create realistic financial projections that accurately reflect the current state of the business and its future potential. This requires a deep understanding of the industry, market trends, and the company’s own strengths and weaknesses. When creating financial projections, it’s important to be conservative in your estimates and take into account any potential risks or uncertainties that could impact the business’s performance.

Using Financial Projections for Business Planning

Financial projections play a crucial role in the business planning process. They help to identify potential growth opportunities, assess the feasibility of new initiatives, and evaluate the impact of strategic decisions on the company’s financial health. By using financial projections as a guide, businesses can make informed decisions that are grounded in data and analysis, rather than guesswork or intuition.

Challenges of Financial Projections

While financial projections are an invaluable tool for business planning, they also come with their own set of challenges. For example, predicting future revenue and expenses can be difficult, especially in industries with fluctuating demand or market conditions. Additionally, unexpected events such as economic downturns or changes in regulations can quickly render financial projections obsolete. To address these challenges, businesses should regularly review and update their financial projections to ensure they remain accurate and reliable.

Conclusion

In conclusion, financial projections are a vital component of business planning that provide valuable insights into the future of a company. By creating realistic and accurate financial projections, businesses can make informed decisions, manage risks, and navigate market uncertainties with confidence. While financial projections may come with challenges, they are an essential tool for any business looking to achieve long-term success and sustainable growth.